In the fast-evolving insurance landscape, Managing General Agents (MGAs) are increasingly turning to Innovation Labs to stay ahead of the curve. These labs serve as incubators for cutting-edge technologies like AI, automation, and customer experience (CX) tools.

What Is an Innovation Lab?

An innovation lab is a dedicated space where a team works full-time to explore and develop new and creative ideas. These labs can be permanent setups or temporary events like hackathons, which are short, intensive innovation sprints held in special spaces.

Unlike traditional innovation programs, which often happen internally without needing a physical location, innovation labs bring people together under one roof—including company employees, startup founders, industry experts, and even university researchers. Sometimes, these labs are used only by internal teams, but often they thrive on collaboration between diverse minds.

You might hear innovation labs called accelerators, incubators, or research hubs—and while the names vary, the idea remains the same: it’s a space created to spark innovation. In fact, even a regular meeting room or an unused office can become an innovation lab if it’s used for brainstorming and building new solutions.

At their core, innovation labs aim to drive growth and create value for the organization by transforming bold ideas into real-world impact.

The Rise of Innovation Labs in Insurance

Innovation labs are dedicated spaces where insurance companies, including MGAs, experiment with emerging technologies to solve industry challenges. These labs foster a culture of innovation, allowing MGAs to test AI-driven solutions, automate processes, and enhance customer experiences. While specific details about innovation labs at leading MGAs like Brown & Brown or Amwins are not widely publicized, the broader insurance industry’s embrace of such labs suggests that MGAs are likely investing in similar initiatives to remain competitive.

According to McKinsey, the insurance industry is on the verge of a “seismic, tech-driven shift” by 2030, with AI and automation playing a central role in transforming customer interactions and operational efficiency. For MGAs, which often specialize in niche markets like pet insurance or cyber risk, innovation labs provide a platform to develop tailored solutions that meet unique customer needs.

The Innovation Imperative for MGAs

Managing General Agents (MGAs) play a distinctive role in the insurance industry. They have the authority to underwrite policies and bind coverage on behalf of insurers, acting as specialized intermediaries. Traditionally, their focus was on facilitating transactions—but the rise of digital technologies has elevated their role to that of innovation leaders.

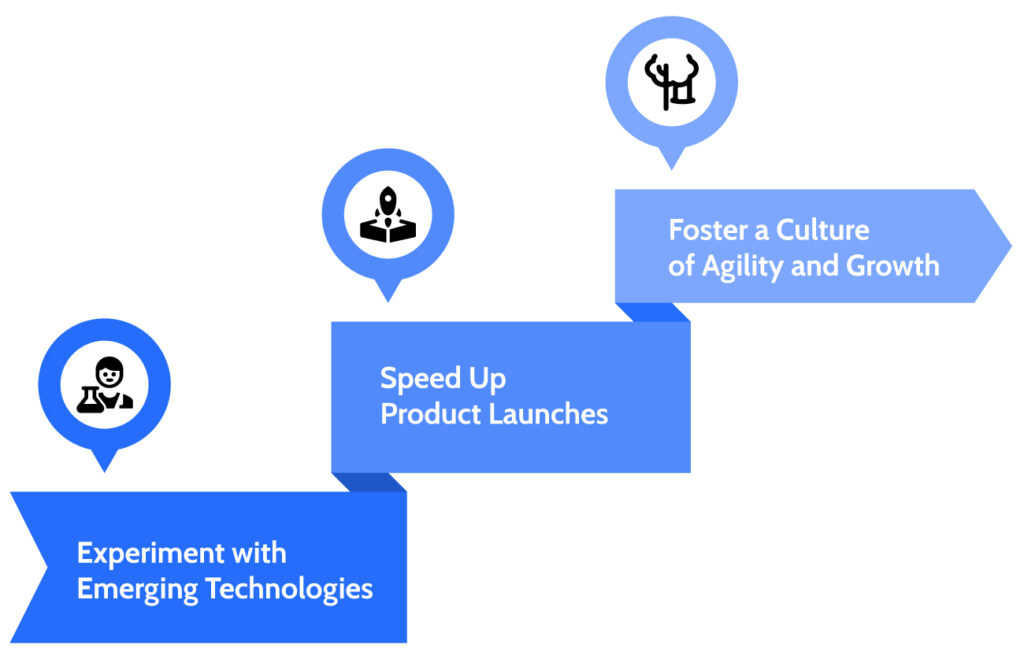

This is where Innovation Labs come in, helping MGAs transition from operational to strategic thinkers. These labs offer a powerful platform that allows MGAs to:

- Experiment with Emerging Technologies: Whether it’s AI-driven underwriting or robotic process automation (RPA), innovation labs act as a safe “sandbox” to test, refine, and roll out new solutions quickly.

- Speed Up Product Launches: Innovation labs enable MGAs to develop and deliver niche insurance products faster, allowing them to stay ahead of shifting market needs and customer expectations.

- Foster a Culture of Agility and Growth: More than just a testing ground, these labs instil a mindset of continuous learning, data-driven thinking, and the freedom to fail and iterate—traits that are essential for long-term success.

The real challenge for MGAs today isn’t just about using new technology—it’s about building a sustainable ecosystem for innovation that evolves with the market. Innovation labs provide this foundation—a dedicated space where ideas are not just explored but brought to life through collaboration, creativity, and strategy.

The Real-World Impact: The Pet Insurance Frontier

While specific MGA innovation lab case studies for pet insurance are emerging, the overarching trend is clear. JAB Holding Company, through its creation of Independence Pet Holdings (IPH), exemplifies how strategic investment and consolidation in the pet insurance market can lead to massive scaling.

While not an MGA innovation lab in the traditional sense, their approach to building a comprehensive ecosystem, including owning underwriting entities like IAIC and leveraging technology for customer engagement (e.g., Figo’s Pet Cloud), highlights the importance of technological foresight and strategic execution in this booming sector.

The pet insurance market is experiencing significant growth. According to Allied Market Research, the global pet insurance market was valued at $10.1 billion in 2023 and is projected to reach $38.3 billion by 2033, growing at a CAGR of 14.5% from 2024 to 2033. This growth is driven by increasing pet ownership and rising veterinary expenses.

The Future of MGAs: A Customer-Centric Approach

As the insurance industry evolves, MGAs that prioritize AI, automation, and customer experience through innovation labs will be best positioned to succeed. By 2030, McKinsey predicts that more than half of claims activities will be automated, and customer interactions will be highly personalized, driven by real-time data and AI. For MGAs, this means not only improving operational efficiency but also building stronger relationships with policyholders through tailored, seamless services.

Innovation labs will play a critical role in this transformation, enabling MGAs to experiment with emerging technologies, refine their offerings, and stay ahead of competitors. By focusing on customer experience, MGAs can differentiate themselves in a crowded market, fostering loyalty and driving growth.

Conclusion

The future of (MGAs) lies where technology, innovation, and customer focus meet. In today’s fast-evolving insurance landscape, Innovation Labs are no longer a luxury they’re a necessity. They act as the strategic heart of growth and help MGAs stand out in a crowded market.

An innovation lab isn’t about finding a one-time solution; it represents a mindset of constant experimentation, learning, and adapting—even from failure. There’s no “magic fix” that guarantees long-term success. Instead, MGAs must treat innovation as an ongoing journey, not a destination. Those MGAs that understand this and take action—by building strong technological foundations, encouraging a culture that embraces AI and digital thinking, and committing to continuous improvement—won’t just keep up with change. They’ll lead it, becoming vital players in the global insurance ecosystem and trusted partners for the future.

Abhay Mishra

Growth Specialist