The Canadian insurance landscape is on the brink of a significant regulatory shift—and the spotlight is now on Managing General Agents (MGAs). With new MGA-specific regulations coming into effect in Ontario in 2026, this reform marks a strategic move toward building greater transparency, accountability, and consumer trust in insurance distribution.

But what does this mean for MGAs, insurers, and technology enablers across Canada and North America?

Why are the New MGA Regulations a Game-Changer?

For years, compliance efforts across the insurance ecosystem have predominantly focused on carriers and insurers. However, recent challenges—including agent misconduct, policy mis-selling, and lack of licensing clarity—have exposed critical gaps in the first and most important link in the value chain: the point of sale.

Across Canada and globally, consumer concerns have mounted around:

- Misleading benefit illustrations and hidden charges

- Sales by inadequately trained or unlicensed agents

- Claims rejections caused by unclear documentation

- Lack of oversight on agent conduct and transaction history

In response, Ontario’s regulatory framework is raising the bar—placing accountability on MGAs to standardize recruitment, training, monitoring, and compliance processes.

Key Regulatory Priorities for MGAs in Canada (and Why They Matter)

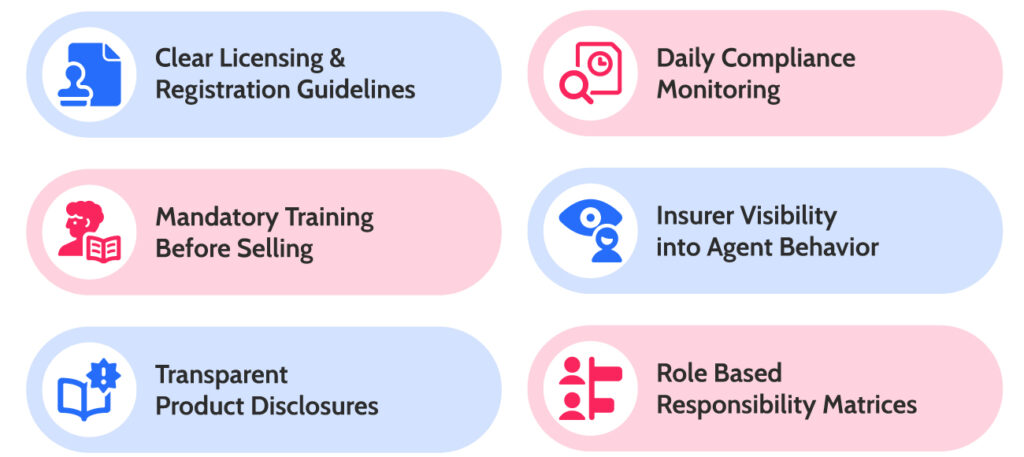

Ontario’s proposed rules signal a shift from reactive to proactive compliance. Here’s what’s changing:

Structured Recruitment & Suitability Checks

MGAs will need vet agents more rigorously ensuring fit for role, ethical orientation, and communication ability.

- Clear Licensing & Registration Guidelines: No ambiguity. Licensing requirements will be standardized and trackable, reducing the risk of unqualified agents representing insurers.

- Mandatory Training Before Selling: Agents must be trained on product features, compliance, and customer suitability before engaging with the public.

- Transparent Product Disclosures: Realistic, regulator-approved benefit illustrations will become mandatory—ensuring customers have a fair view of returns and risks.

- Daily Compliance Monitoring: A compliance officer or system must oversee transactions, interactions, and agent activities in real time.

- Insurer Visibility into Agent Behavior: Carriers will be expected to validate agent recruitment, sales behavior, and customer agreements—creating a shared responsibility model.

- Role-Based Responsibility Matrices: Defined duties across agents, MGAs, and carriers will help avoid regulatory blind spots.

From Compliance to Competitive Advantage

These reforms are not just about ticking regulatory boxes—they are about restoring consumer confidence in the insurance sales process. In a competitive market, the agents and MGAs who champion ethics and transparency will lead.

By aligning with these principles, insurers and MGAs can:

- Enhance brand reputation

- Reduce risk exposure and mis-selling complaints

- Improve agent performance and policyholder satisfaction

- Future-proof themselves against evolving cross-border compliance

How Technology Can Help MGAs Prepare?

To meet these demands, the insurance industry must embrace technology as a compliance ally. From agent onboarding to compliance documentation and real-time sales monitoring, the need for integrated, audit-ready platforms has never been greater.

At iNube, we partner with insurers and MGAs across Canada and the U.S. to digitize:

- Agent lifecycle management

- Licensing and credential verification

- Digital training journeys

- Sales transaction audits

- Compliance dashboards and regulator-ready reports

Don’t Just Comply—Lead

The Ontario MGA regulations are more than a mandate—they’re a moment of reflection. What kind of insurance experience do we want to deliver?

One where consumers are respected, sales are transparent, and trust is non-negotiable.

With 2026 on the horizon, forward-looking MGAs and insurers now have an opportunity to lead by example. And those who leverage smart, scalable technology to bring compliance to the core of their distribution model—will not just comply. They’ll outpace the market.

Sridhar Ganesan

Head – Innovation and Implementations